1099 Misclassification

The gig economy has witnessed massive growth in the last decade, fueled by the 2008 recession and the more recent pandemic. But are all the workers who file 1099s with the IRS really independent contractors? In many cases, these workers have been misclassified and are actually employees of the companies they work for. Here’s the essential information you need to know about 1099 misclassification and what to do if you believe you have been misclassified as an independent contractor when you’re really an employee.

What Is 1099 Misclassification?

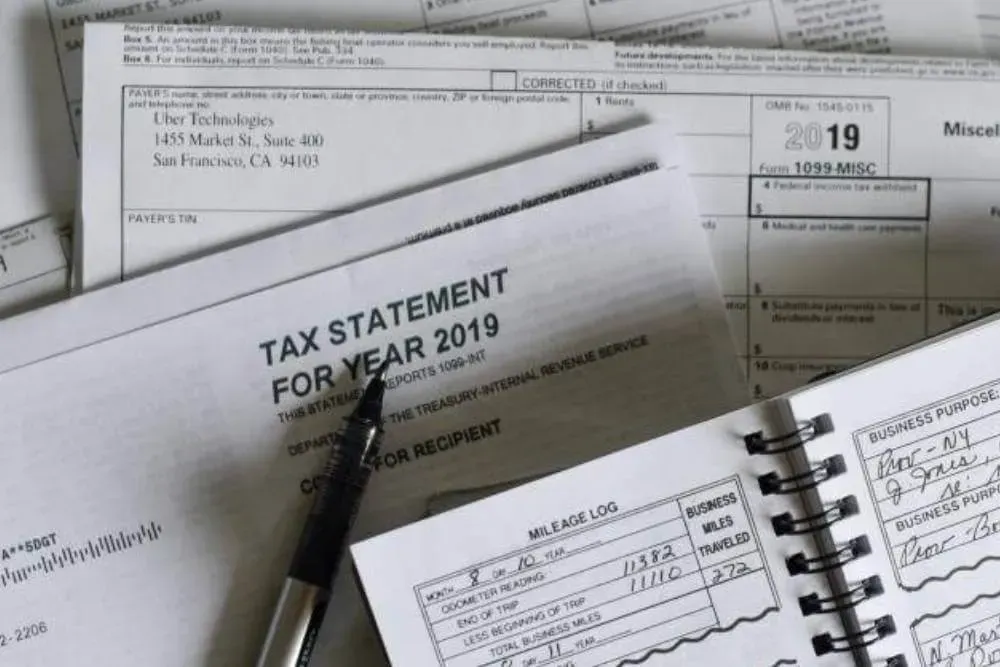

When an employer classifies workers as 1099 contractors (often called freelancers, independent contractors, or self-employed people) instead of formally making them employees, this is known as “misclassification” or “1099 misclassification.” It takes its name from IRS Form 1099, which clients send to contractors in order to pay their taxes (versus the W-2 form that employees receive as a wage and tax statement).

Sometimes misclassification is a genuine mistake on the part of the employer, but more often it is done intentionally, making it a form of fraud. Just because an employer says a worker is a 1099 contractor and not an employee doesn’t make it so, as we discuss below, even if they have the worker sign a contract to that effect.

Why Do Employers Misclassify Workers?

Companies misclassify their workers as independent contractors to save money and increase their profit margins. When a worker is a 1099 contractor and not an employee, the employer doesn’t have to pay minimum wage, overtime, or payroll taxes, like Social Security. The employer also is not required to pay for sick time, family leave, or vacations. They don’t pay health benefits either, which is a huge savings for them.

Additionally, employers who misclassify employees as freelancers do not have to comply with many other laws regarding meal and rest breaks during work hours. They may not be subject to laws regarding workplace safety, which allows employers to cut corners when it comes to manpower and expenses. Companies that technically don’t have any employees and just use misclassified contractors to do work can get away without having a human resources (HR) department, which further saves on money that goes right to their bottom line.

How Does 1099 Misclassification Hurt Workers?

You might be tempted to think that it doesn’t matter whether you’re a 1099 contractor or employee. It’s all just IRS lingo, right? Wrong.

Misclassification hurts workers who should really be employees by denying them many rights and benefits that should be theirs, including:

- Tax advantages (self-employed individuals pay higher taxes)

- Minimum wage

- Overtime pay

- Meal and rest breaks

- Protection against discrimination, harassment, and retaliation

- Health insurance

- Paid time off for sick leave, family leave, and vacations

- Retirement accounts (401K), pensions, stock options, and other perks

- Workers compensation insurance for injuries on the job

- Unemployment insurance if laid off

- Legal right to organize or join a union

In most cases, it’s much more difficult to make a case for workplace retaliation, including after whistleblowing, if a worker is a 1099 contractor and not an employee.

The Misclassification Conundrum in California

California has been at the forefront of protecting workers who have been misclassified as 1099 contractors. State legislation was passed recently (Assembly Bill 5, more commonly known as AB 5) to clarify which category workers belong in, and proposed federal regulations followed suit (the PRO Act).

However, this legislation has been the subject of debate both within California and nationally because some parties feel it doesn’t do enough while others believe it goes too far in making workers employees. As recently as this summer, for example, owner-operator truckers have been protesting that they actually want to be their own bosses and not employees of a company.

Likewise, journalists and freelance writers have also bristled at AB 5 because of the way the bill delineated their work. It would have turned clients into employers, which caused multiple conflicts for workers. For example, if you have five freelance clients who are now legally employers, which one pays your health benefits? Do they get to determine your work hours? Can they require you to commute to an office instead of working from home?

The upshot was that many media companies threatened to stop hiring workers from California, forcing the state to rethink the classification process by removing article caps for some reporters, writers, and photographers, as well as adding exceptions for business-to-business contracting jobs.

But, will clients still be skittish to hire California workers, or will they feel compelled to make them employees, even against the will of those workers? The court has yet to make a decision on similar issues for truckers, whose work is integral to preventing supply chain and shipping delays across the country.

On the other side of the coin, many rideshare drivers, such as those who work for Uber and Lyft, felt they needed better protection from misclassification as 1099 workers, and many wanted the right to organize in a union as well. They believed they should be classified as employees, which was the catalyst in large part for the passing of AB 5. However, corporate pressure and a massive PR campaign led to a victory for the companies at the ballot box, ultimately exempting these drivers from AB 5 protections, denying them many benefits and shifting the tax burden to them.

What Is the ABC Test?

At the crux of the classification conundrum in California is what is known as the ABC test to help determine if a worker should be a 1099 contractor or employee. Most workers are presumed to be employees. But you may be considered an independent contractor if it is established that:

- The worker is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact;

- The worker performs work that is outside the usual course of the hiring entity’s business; and

- The worker is customarily engaged in an independently established trade, occupation, or business of the same nature as that involved in the work performed.

An important fact to remember is that all of these factors has to be true before you can be declared an independent contractor.

What Can You Do If You Believe You Have Been Misclassified?

Clearly, worker classification is a hot-button issue and one that is evolving. It’s also a complex area of employment law. And, although some workers were perhaps mistakenly caught up in legislation like AB 5, millions more are misclassified as 1099 contractors when they should be employees. These workers are being denied income, benefits, and protections to which they’re entitled, and their employers are subject to legal penalties.

Furthermore, workers who have been misclassified may be entitled to:

- Unpaid wages

- Unpaid overtime

- Unpaid meal and rest breaks

- Penalties and interest

Do you think you have been misclassified as a 1099 worker when you should be an employee? The Employee Law Group can help you determine if you have a case and how you should proceed next. We have a team of seasoned lawyers who can advise you about this changing landscape and represent you if litigation is viable.

You have nothing to lose with a free initial consultation. Call the Employee Law Group today at 310-606-0065, or reach out online to let us know more about your misclassification case and how we can assist.

Managing Attorney - David Mallen

David Mallen is the managing attorney at Employee Law Group in Torrance, California, and a respected labor and employment lawyer who has represented thousands of workers since beginning his practice in 1992. He has been recognized as a Southern California Super Lawyer every year from 2004 to the present.